TL;DR:

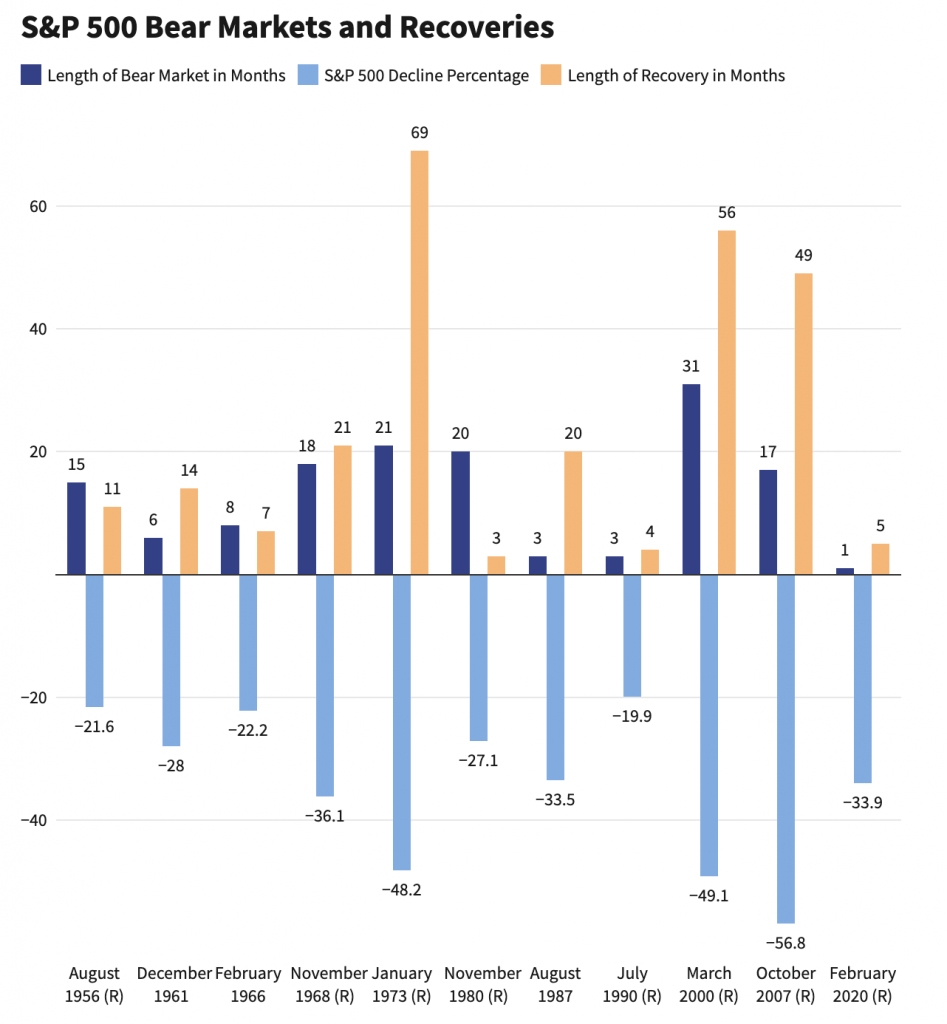

- Bear markets are where long-term wealth gets created

- Staying vested is good, but we should continue investing

- Opt for Dollar-Cost Averaging (DCA) approach during volatile times

Read on: Investing During A Bear Market: Could A Dollar-Cost Averaging (DCA) Approach Make More Sense

Albeit a sponsored post, it provides a good understanding on investing during volatile times and why DCA would work.

If you are staying vested:

- A little more active management maybe necessary

- Rebalancing of assets could be done in according to your risk tolerance