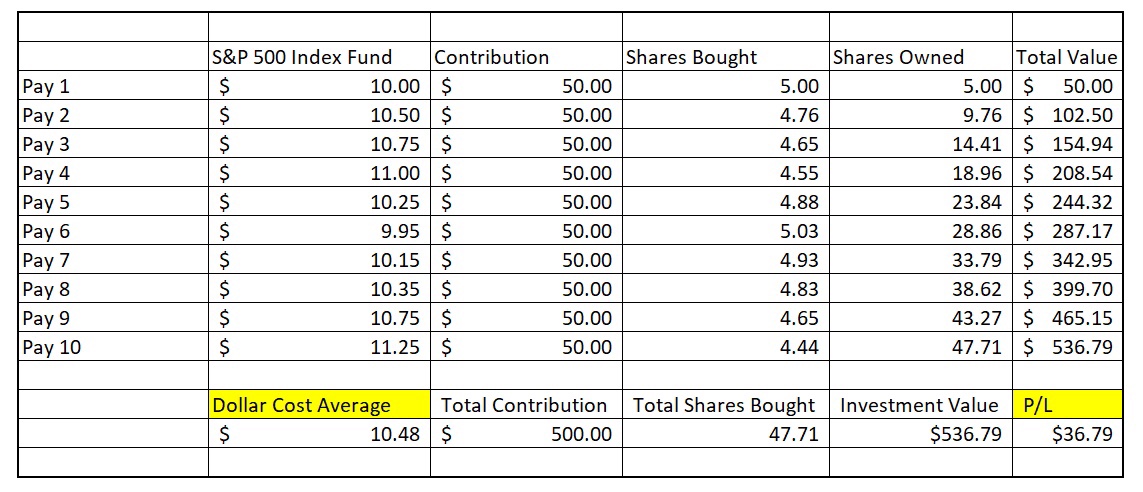

Dollar-cost averaging (DCA) is an investment strategy in which you:

- put in regular contributions (for example, monthly or quarterly)

- over a period of time (say 3 to 5 years, 10 years, or more; depending on your objective)

The strategy is to ride or sail thru investment and market fluctuations such that you buy more shares/units when price is low and buy less when price is high.

DCA hence mitigates and lowers your risk of losing over the period of your investment.

In times of crisis, investors who are on DCA tend to sit back and let their investments ride the fluctuations. While investors who put in a single sum investment would panic as to whether to sell off or hold and rebalance their portfolios.

For more information, do read: Dollar-cost Averaging